Introduction

In today’s globalized world, the need to send money overseas has become increasingly common. Whether you’re sending funds to family members abroad, making international business transactions, or supporting loved ones studying or traveling abroad, finding a reliable and cost-effective money transfer service is essential.

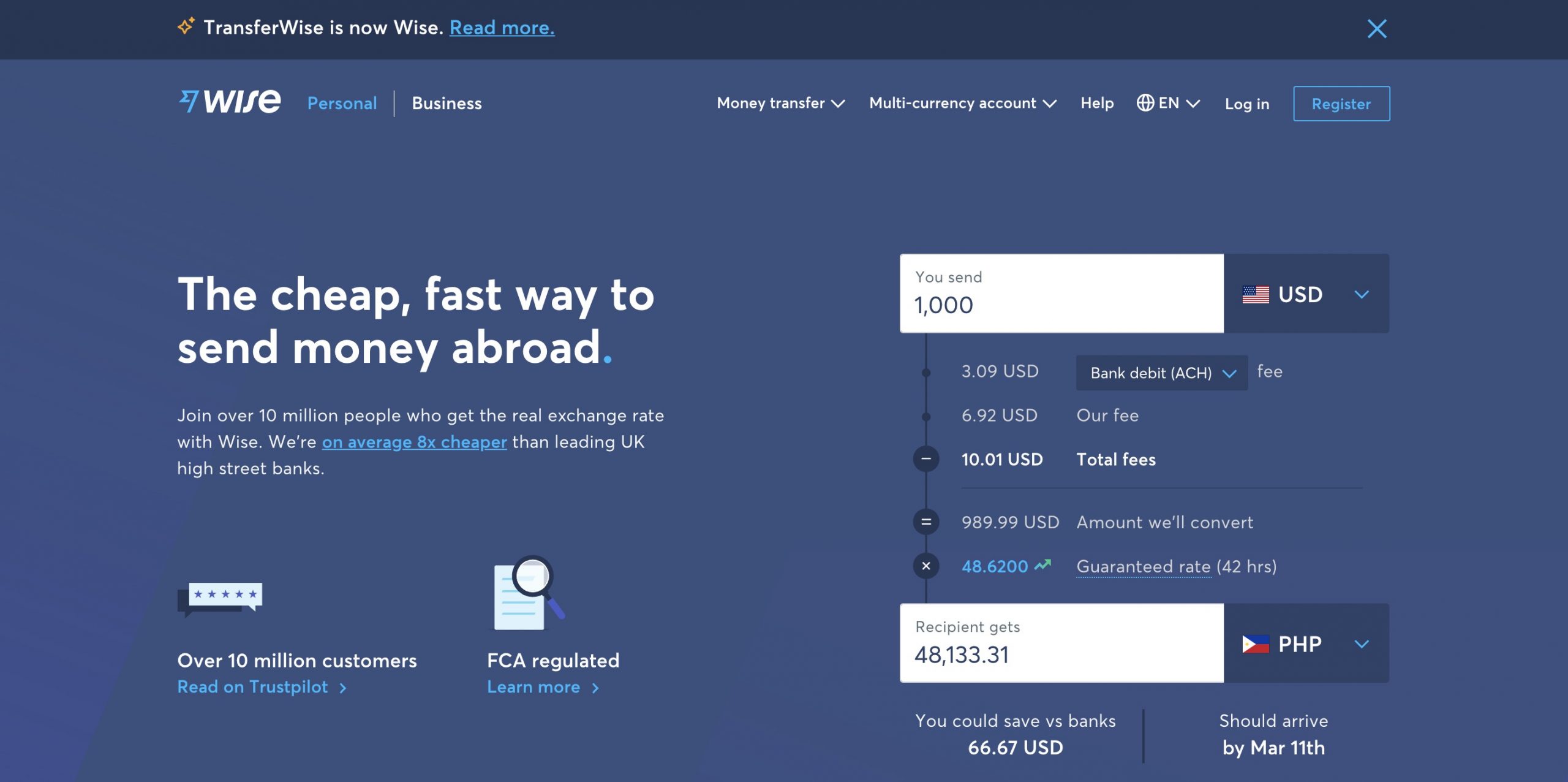

One such service that has gained popularity in recent years is Wise, formerly known as TransferWise. Wise is an online platform that offers a simple, transparent, and affordable way to send money internationally. With its innovative peer-to-peer model, Wise aims to disrupt the traditional banking system by eliminating hidden fees and offering competitive exchange rates.

With millions of users around the world, Wise has become a trusted name in the world of international money transfers. But is it really the cheapest way to send money overseas? In this comprehensive review, we’ll dive into how Wise works, its key features, fees and exchange rates, as well as its pros and cons compared to traditional banks and other money transfer services.

Whether you’re a frequent international money sender or just need to make occasional transfers, understanding the ins and outs of Wise can help you make informed decisions about your financial needs. So, let’s explore Wise in detail and determine if it’s the right solution for your international money transfer requirements.

How does Wise/TransferWise work?

At its core, Wise operates on a peer-to-peer system that matches individuals who are sending money in one currency with those who are receiving money in a different currency. This model allows for local transfers in both the sender’s and receiver’s countries, significantly reducing fees and eliminating the need for currency exchange.

When you initiate a transfer with Wise, you send money to a local account in your own country, in your own currency. Wise then matches your transfer with someone who wants to send an equivalent amount to your desired recipient in their local currency. The money is then sent from the matched individual’s local account to the recipient in their currency. By conducting two local transfers instead of one international transfer, Wise eliminates the need for costly cross-border transactions.

Let’s take an example to illustrate how Wise works. Suppose you want to send 1,000 USD to a friend in Germany who needs 900 Euros. Instead of converting your dollars into euros and initiating an international transfer, Wise will find someone who wants to send 900 Euros to the United States. You will transfer 1,000 USD to Wise’s local account in the United States, and the matched individual will transfer 900 Euros to your friend’s local account in Germany.

By eliminating the need for currency conversion and international transfers, Wise can offer customers better exchange rates compared to traditional banks and other money transfer services. Its transparent fee structure ensures that you know exactly how much you’re paying in fees upfront, with no hidden charges.

In addition to its peer-to-peer transfer model, Wise also utilizes advanced technology to streamline the money transfer process. Wise has developed a sophisticated algorithm that matches transfers instantaneously, ensuring quick and efficient transactions. The platform also provides real-time updates on the status of your transfer, allowing you to track your funds every step of the way.

Overall, Wise’s peer-to-peer system, combined with its technological advancements, makes it a reliable and efficient way to send money internationally while saving on fees and receiving competitive exchange rates.

Key Features of Wise/TransferWise

Wise offers a range of features and services that make it a standout option for international money transfers. Let’s explore some of the key features that set Wise apart:

- Transparent Fee Structure: Wise prides itself on its transparent and upfront fee structure. When you initiate a transfer, Wise displays the exact amount you’ll pay in fees, along with the real-time exchange rate. This level of transparency allows you to know exactly how much your transfer will cost, without any hidden charges or surprises.

- Competitive Exchange Rates:> Wise offers highly competitive exchange rates, which are often better than those provided by traditional banks. By utilizing its peer-to-peer model, Wise can offer customers better rates by eliminating the need for currency conversion and cross-border transfers. This ensures that more of your money reaches the recipient, as opposed to being lost in unfavorable exchange rates.

- Fast Transfers: Wise’s advanced technology and peer-to-peer model enable swift and efficient transfers. In many cases, transfers are completed within a matter of hours. Even for transfers that require additional processing time, Wise provides real-time updates, allowing you to track your funds every step of the way.

- Wide Range of Supported Currencies: Wise supports over 55 currencies, making it a versatile option for sending money to various countries around the world. Whether you need to send money to popular destinations like the United States, United Kingdom, or Germany, or less-common currencies, Wise has you covered.

- Borderless Account: Wise also offers a borderless account, which allows you to hold and manage money in multiple currencies. This feature is particularly useful for frequent travelers, expats, and individuals conducting business in different countries. With the borderless account, you can receive payments in different currencies and convert and send money at competitive rates.

- Wise Debit Card: Wise provides a debit card that is linked to your borderless account, allowing you to spend money in different currencies at local rates. This eliminates the need for expensive currency conversions and provides a convenient way to access your funds when traveling or making online purchases.

- Business Solutions: In addition to personal transfers, Wise offers business solutions for companies of all sizes. Whether you need to pay international suppliers, manage payroll for global employees, or receive funds from international clients, Wise’s business services cater to your specific needs.

These key features make Wise a popular choice for individuals and businesses alike. Its transparent fees, competitive exchange rates, fast transfers, and versatile account options provide a comprehensive solution for international money transfers.

Transfer Fees and Exchange Rates

One of the main advantages of using Wise for international money transfers is its transparent fee structure and competitive exchange rates. Let’s delve into the details of transfer fees and exchange rates offered by Wise:

Transfer Fees: Wise charges a small, upfront fee for each transfer. The fee amount depends on the currencies involved and the transfer amount, but it is generally much lower than what traditional banks charge. By offering transparent fees, Wise ensures that you know exactly how much you’re paying for the transfer, without any hidden charges or surprises.

Exchange Rates: Wise uses the mid-market exchange rate for its transfers, which is the fairest and most transparent exchange rate available. Unlike traditional banks that often mark up the exchange rate to make a profit, Wise offers competitive rates that are closer to the real market rate. This means more of your money goes to the recipient, as you receive a fairer exchange rate without any hidden fees.

It’s also important to note that Wise’s peer-to-peer model enables it to bypass costly currency conversions. By matching individuals sending and receiving money in different currencies, Wise eliminates the need for cross-border transfers, which can incur additional fees and exchange rate markups.

By combining competitive exchange rates with transparent fees, Wise provides a cost-effective solution for international money transfers. Whether you’re sending a small amount to a family member or conducting large business transactions, Wise ensures that you get the most value for your money.

When comparing Wise’s fees and exchange rates to traditional banks, customers consistently find that Wise offers better rates and lower fees. This is especially true for frequent senders and those who regularly make international transactions. Wise’s commitment to transparency and fair pricing makes it a top choice for individuals and businesses looking to save on transfer costs.

Sending Money with Wise/TransferWise

Sending money with Wise is a straightforward and user-friendly process. Whether you’re using their website or mobile app, the steps to initiate a transfer are simple and intuitive. Here’s how it works:

- Set Up Your Account: To begin, you’ll need to create an account with Wise. This involves providing your personal information and verifying your identity, as per regulatory requirements. Once your account is set up, you can start the transfer process.

- Enter Transfer Details: Next, you’ll need to enter the details of your transfer. This includes the amount you want to send, the recipient’s details (such as their name and bank account information), and the currencies involved. Wise will display the exact amount the recipient will receive, along with the transfer fee and the expected transfer timeline.

- Make Payment: After reviewing the details, you’ll be prompted to make the payment for your transfer. Wise supports various payment methods, including bank transfers, debit cards, and credit cards, depending on your location. Simply select your preferred payment method and follow the prompts to complete the payment.

- Track and Receive Funds: Once you’ve made the payment, you’ll be able to track the progress of your transfer in real-time. Wise provides updates on the status of your transfer, allowing you to monitor when the funds are sent and when they are received by the recipient. You’ll also receive email notifications at key milestones throughout the transfer process.

- Confirmation to the Recipient: Upon completion of the transfer, the recipient will receive an email notification informing them that the funds are available. They can then choose to either withdraw the money to their bank account or keep it in their Wise borderless account.

Wise prides itself on its fast and reliable transfer times. In many cases, transfers are completed within a few hours, depending on the currencies involved and the processing times of the recipient’s bank. However, certain factors can affect transfer times, such as bank holidays, weekends, or additional verification requirements.

It’s worth noting that Wise offers additional services and features for specific countries. For example, in some countries, you can send money directly to mobile wallets or top up prepaid cards. Wise continually expands its services to cater to the evolving needs of its global user base.

Overall, whether you need to send money to family and friends, make international payments, or support loved ones studying abroad, Wise provides a user-friendly platform that simplifies the process of sending money internationally.

Receiving Money with Wise/TransferWise

Receiving money with Wise is just as convenient as sending it. When someone sends you funds through Wise, you can choose to receive the money directly in your bank account or keep it in your Wise borderless account. Here’s how it works:

- Provide Your Bank Account Details: To receive money in your bank account, you’ll need to provide the sender with your bank account details. This typically includes your bank name, account number, and any required routing or IBAN numbers. Providing accurate and complete information ensures that the funds are correctly transferred to your account.

- Receive the Funds: Once the sender initiates the transfer, you’ll receive an email notification from Wise informing you that funds are on the way. The transfer process usually takes a few hours, depending on the currencies involved and the processing times of the sender’s bank.

- Withdraw or Keep in Your Borderless Account: Once the funds are received, you have the option to either withdraw the money to your bank account or keep it in your Wise borderless account. Withdrawing funds to your bank account is a seamless process and can typically be done through the Wise website or mobile app. If you choose to keep the funds in your borderless account, you can hold and manage multiple currencies, making it convenient for future transfers or currency conversions.

- Use the Debit Card (Optional): If you have a Wise debit card linked to your borderless account, you can use it to spend the received funds directly. The debit card allows you to make purchases or withdraw cash in local currency without the need for expensive currency conversions.

- Track and Manage the Funds: Wise provides a user-friendly interface that allows you to track and manage your funds. Through the Wise platform, you can view the transaction history, check exchange rates, and access various account settings. Additionally, you’ll receive email notifications for key updates related to your received funds.

Receiving money with Wise is hassle-free and offers the flexibility to manage your funds according to your specific needs. Whether you prefer to transfer the received funds to your bank account or utilize the multi-currency options provided by the borderless account, Wise ensures a seamless experience.

It’s important to note that Wise’s capabilities for receiving money may vary depending on the country and currency involved. While bank transfers are the most common method for receiving funds, Wise also supports other options such as direct transfers to mobile wallets or top-ups to prepaid cards in certain countries.

Overall, receiving money with Wise is a convenient and efficient process, empowering you to access and utilize your funds in the most cost-effective and flexible manner.

Wise/TransferWise Borderless Account

The Wise/TransferWise Borderless Account is a unique and versatile feature that sets it apart from traditional banking services. It allows you to hold and manage money in multiple currencies, making it a convenient solution for individuals and businesses with international financial needs.

Here are some key features of the Wise/TransferWise Borderless Account:

- Multi-Currency Support: With the Borderless Account, you can hold and transact in over 50 currencies around the world. This means you can receive payments in different currencies, make transfers between currencies, and even spend money in local currencies using the Wise debit card.

- Local Bank Account Details: Wise provides you with local bank account details for major currencies, such as USD, EUR, GBP, AUD, and more. This allows you to receive payments from international clients or partners as if you had a local bank account in their country. It eliminates the need for costly international wire transfers and reduces transaction fees.

- Conversion at Competitive Rates: When you need to convert money between currencies within your Borderless Account, Wise offers competitive and transparent exchange rates. You can convert funds instantly and avoid the high fees and hidden charges typically associated with traditional bank conversions.

- Send and Receive Money: With the Borderless Account, you can send and receive money globally with ease. You can initiate transfers directly from your account, choosing the currency you want to send and the recipient’s currency for efficient and cost-effective transactions.

- Integration with Debit Card: The Wise Borderless Account seamlessly integrates with the Wise debit card. You can link your debit card to your Borderless Account, allowing you to spend money in different currencies at the real exchange rate, bypassing expensive currency conversion fees.

- Manage and Track Funds: Wise provides a user-friendly online platform and mobile app that allows you to manage and track your funds in real-time. You can view transaction history, check balances in different currencies, and set up rate alerts to stay updated with exchange rate fluctuations.

Whether you’re an expat, a digital nomad, a small business owner, or a freelancer working internationally, the Wise/TransferWise Borderless Account offers a convenient and cost-effective solution. It enables you to receive, hold, and manage funds in multiple currencies, providing ultimate flexibility and control over your finances.

The Borderless Account not only simplifies international money transfers but also streamlines the process of receiving payments from clients or partners in different countries. It eliminates the need for multiple bank accounts and saves you time and money on cross-border fees and conversions.

Wise/TransferWise has revolutionized the way individuals and businesses manage their finances across borders, and the Borderless Account is a testament to their commitment to providing innovative and customer-focused solutions.

Wise/TransferWise Debit Card

The Wise/TransferWise Debit Card is a powerful tool that complements the features of the Borderless Account, offering users convenience and flexibility when it comes to spending money internationally. Let’s explore the key features and benefits of the Wise/TransferWise Debit Card:

- Multi-Currency Spending: The debit card allows you to spend money in different currencies directly from your Borderless Account. When making purchases or withdrawing cash, the card automatically converts the funds at the real exchange rate, without any additional fees or markups. This feature is especially beneficial for frequent travelers and individuals who frequently make cross-border transactions.

- Low Fees: Unlike traditional banks that often charge high fees for international transactions and currency conversions, the Wise/TransferWise Debit Card is known for its low and transparent fees. You’ll avoid costly hidden charges and enjoy the convenience of spending in multiple currencies at competitive rates.

- Control and Flexibility: The debit card provides you with control over your spending. You can decide which currency to use for each transaction, ensuring that you take advantage of favorable exchange rates. Additionally, you can easily manage your card settings through the Wise platform, allowing you to enable or disable certain features, set spending limits, and freeze or unfreeze your card instantly.

- Security: The Wise/TransferWise Debit Card prioritizes the security of your funds and personal information. It utilizes the latest security measures, including EMV chip technology, two-factor authentication, and real-time transaction notifications. You can have peace of mind knowing that your transactions are protected.

- Convenient Mobile App: The Wise mobile app complements the debit card perfectly, providing you with instant access to your Borderless Account and card details. You can easily monitor your balances, review transactions, and manage your card settings while on the go.

With the Wise/TransferWise Debit Card, you can say goodbye to expensive currency conversion fees and enjoy the freedom of spending money internationally without the usual hassle. The ability to spend in multiple currencies directly from your Borderless Account, coupled with low fees and robust security measures, makes the debit card a valuable asset for individuals, travelers, and businesses with global financial needs.

Whether you’re paying for accommodations, shopping online, or withdrawing cash from ATMs abroad, the Wise/TransferWise Debit Card simplifies the process and helps you save money. It empowers you to take control of your finances while enjoying the convenience and peace of mind that comes with a trusted and innovative money transfer service.

Wise/TransferWise for Business

Wise/TransferWise offers a range of services tailored specifically for businesses, providing cost-effective solutions for international payments and currency conversions. Whether you’re a small startup, a growing SME, or a multinational corporation, Wise/TransferWise for Business can help streamline your international financial operations. Here’s what you need to know:

- International Payments: Wise/TransferWise enables businesses to make international payments quickly and efficiently. Instead of traditional bank transfers that often come with high fees and unfavorable exchange rates, Wise/TransferWise offers competitive rates and transparent fees, ensuring that more of your money reaches its destination.

- Multi-Currency Account: With the Wise/TransferWise Borderless Account for Business, you can hold and manage money in multiple currencies. This allows you to receive payments from clients around the world in their local currencies, avoiding costly conversions and reducing fees. It also simplifies the process of managing finances in different markets.

- Bulk Payments: Wise/TransferWise for Business allows you to make bulk payments efficiently. Whether you need to pay international suppliers, freelancers, or remote employees, you can initiate multiple transfers in a single batch, saving time and streamlining your payment process.

- Global Payroll: Managing payroll for employees in different countries can be complex and costly. Wise/TransferWise for Business offers a solution with its multi-currency payroll feature. You can easily pay employees around the world in their local currencies, eliminating the need for expensive bank transfers or third-party services.

- Integration and API: Wise/TransferWise provides a range of integration options, making it easy to incorporate their services into your existing business systems and processes. You can utilize their API to automate payments, reconcile transactions, and access real-time exchange rates, enhancing efficiency and reducing manual work.

- Business Debit Card: Similar to the personal Wise/TransferWise Debit Card, the business debit card allows you to spend funds directly from your Borderless Account. This is particularly useful for travel expenses, business-related purchases, and managing expenses in multiple currencies.

Wise/TransferWise for Business offers a cost-effective alternative to traditional bank services, providing businesses of all sizes with the tools they need to manage their international finances efficiently. With competitive rates, transparent fees, and a user-friendly platform, Wise/TransferWise for Business is trusted by millions of companies worldwide.

By leveraging Wise/TransferWise for Business, you can improve your cash flow, reduce costs, and simplify your international financial operations. Whether you’re a small business looking to expand into new markets or a global enterprise managing complex transactions, Wise/TransferWise for Business is a reliable and efficient solution.

Wise/TransferWise Security and Safety

When it comes to handling your money and personal information, Wise/TransferWise prioritizes security and safety. Here are the key measures they have in place to ensure the protection of your funds and data:

- Regulatory Compliance: Wise/TransferWise operates as a licensed and regulated financial institution in the countries where it provides services. They are subject to the regulations and supervision of financial authorities, ensuring adherence to strict standards for security, privacy, and anti-money laundering procedures.

- Authentication and Encryption: Wise/TransferWise employs robust security measures, including secure socket layer (SSL) encryption and two-factor authentication, to protect the transmission of your data. This ensures that your personal information and financial details are encrypted and secure during online transactions and communications.

- Data Protection: Wise/TransferWise follows stringent data protection regulations and guidelines, such as the General Data Protection Regulation (GDPR). They have implemented comprehensive policies and measures to safeguard your personal information, and they are committed to ensuring the privacy and confidentiality of your data.

- Account Security: Wise/TransferWise utilizes advanced security protocols to protect your account. This includes monitoring for suspicious activity, detecting and blocking unauthorized access attempts, and implementing secure password policies. They also provide features like biometric authentication and session management tools to enhance account security.

- Comprehensive Auditing and Controls: Wise/TransferWise maintains a robust system of internal controls and auditing processes to ensure the integrity and security of their operations. Regular internal and external audits are conducted to assess and verify their compliance with industry standards and best practices.

- Secure Partner Network: Wise/TransferWise has partnered with reputable financial institutions and banking partners globally. Their network of trusted partners ensures that your funds are held securely and that transfers are processed through reliable and regulated channels.

Wise/TransferWise’s commitment to security and safety is reflected in their track record and the millions of satisfied customers who have used their services. While Wise/TransferWise takes every precaution to protect your funds and data, it’s important to still exercise caution and follow best practices for online security, such as creating strong passwords and being vigilant of phishing attempts.

By combining their robust security measures, regulatory compliance, and transparent approach, Wise/TransferWise instills confidence and trust in their users, ensuring that your money and personal information are well-protected throughout the money transfer process.

Pros and Cons of Wise/TransferWise

As with any financial service, Wise/TransferWise has its advantages and disadvantages. Here are the pros and cons of using Wise/TransferWise for your international money transfers:

Pros:

- Competitive Exchange Rates: Wise/TransferWise offers highly competitive exchange rates, often better than those provided by traditional banks. This ensures that you get more value for your money when converting currencies.

- Transparent Fees: With Wise/TransferWise, you’ll know exactly how much you’re paying in fees upfront, without any hidden charges. The transparent fee structure gives you peace of mind and helps you calculate the true cost of your transfers.

- Fast Transfers: Wise/TransferWise enables fast transfers, completing many transactions within a matter of hours. Their real-time updates allow you to track your funds every step of the way, providing peace of mind and convenience.

- Multi-Currency Options: The Borderless Account and Wise debit card provide the flexibility to hold and manage multiple currencies in one place. This is especially useful for frequent travelers, expats, and businesses that deal with international transactions.

- User-Friendly Interface: Wise/TransferWise offers a user-friendly platform and mobile app, making it easy to navigate and initiate transfers. Their intuitive design ensures a seamless user experience.

- Security and Safety: Wise/TransferWise prioritizes the security of your funds and personal information. They utilize advanced encryption, authentication processes, and regulatory compliance to protect your data and transactions.

Cons:

- Limited Payment Options: Wise/TransferWise supports various payment methods, but the options available may be limited depending on your location. It’s essential to check which payment methods are available in your country before using the service.

- No Cash Pickup: Unlike some other money transfer services, Wise/TransferWise does not offer cash pickup as a delivery option. Funds can only be transferred to bank accounts or held in the Borderless Account.

- Bank Account Verification: To use Wise/TransferWise, you’ll need to go through a verification process to link your bank account. While this is a necessary security measure, it may require additional time and documentation.

- Dependent on Currency Routes: The availability and speed of transfers may vary depending on the currency routes involved. While Wise/TransferWise supports many currencies, some routes may have slightly longer processing times or limited availability.

Despite a few limitations, Wise/TransferWise offers many benefits that make it a popular choice for international money transfers. Its competitive rates, transparent fees, fast transfers, multi-currency options, user-friendly interface, and emphasis on security and safety make it a reliable and cost-effective solution for individuals and businesses.

It’s important to evaluate your specific needs and compare Wise/TransferWise with other available options to determine if it aligns with your requirements and preferences for international money transfers.

Wise/TransferWise vs. Traditional Banks

When it comes to international money transfers, Wise/TransferWise offers several advantages over traditional banks. Let’s compare the two options to understand how Wise/TransferWise stands out:

Cost Savings:

Wise/TransferWise often provides better exchange rates compared to traditional banks. Banks often mark up the exchange rates, resulting in a higher cost for customers. Wise/TransferWise, on the other hand, uses the mid-market exchange rate and offers transparent fees, allowing users to save money on conversions and transfers.

Transparency:

Wise/TransferWise is known for its transparency. When initiating a transfer, users can see the exact fees, real-time exchange rates, and the amount the recipient will receive. Traditional banks, on the other hand, may have hidden fees, additional intermediary charges, or markups on exchange rates, making it challenging for customers to determine the actual cost of the transfer.

Speed and Efficiency:

Wise/TransferWise generally provides faster transfers compared to traditional banks. While banks may take several days to complete an international transfer, Wise/TransferWise often processes transactions within hours. The real-time status updates provided by Wise/TransferWise allow users to track their funds and have transparency regarding the progress of the transfer.

Multi-Currency Accounts:

Wise/TransferWise offers the Borderless Account, which allows users to hold and manage money in multiple currencies. This feature is particularly useful for individuals and businesses that frequently deal with international transactions. Traditional banks may not provide the same level of convenience and flexibility when it comes to managing funds in different currencies.

User Experience:

Wise/TransferWise provides a user-friendly online platform and mobile app that is easy to navigate. It offers an intuitive interface, real-time updates, and clear transaction history, providing a seamless experience for customers. Traditional banks may have outdated systems and complex procedures, resulting in a less user-friendly experience.

Business Solutions:

Wise/TransferWise offers specific services for businesses, such as bulk payments, global payroll, and multi-currency accounts. These features cater to the unique needs of businesses dealing with international transactions. Traditional banks may have business services available, but they often come with higher fees, slower processing times, and less transparency.

While traditional banks have their advantages, Wise/TransferWise offers cost savings, transparency, speed, multi-currency accounts, a user-friendly interface, and tailored business solutions. Whether you’re an individual or a business, it’s worth considering Wise/TransferWise as a modern and efficient alternative to traditional banks for your international money transfer needs.

Wise/TransferWise vs. Other Money Transfer Services

Wise/TransferWise stands out in the crowded market of money transfer services, offering unique features and cost-effective solutions. Let’s compare Wise/TransferWise with other money transfer services to understand its advantages:

Transparent Fees and Competitive Exchange Rates:

Wise/TransferWise is known for its transparent fee structure and competitive exchange rates. Unlike some other money transfer services that may have hidden fees or significant markups on exchange rates, Wise/TransferWise provides upfront fees and uses the mid-market exchange rate, saving customers money on transfers.

Fast Transfers:

Wise/TransferWise offers fast transfer times compared to many other money transfer services. While some services may take several days to complete, Wise/TransferWise often processes transfers within hours, allowing recipients to receive funds quickly.

Multi-Currency Accounts:

The Wise/TransferWise Borderless Account allows users to hold and manage money in multiple currencies. This feature sets Wise/TransferWise apart from many other services that primarily focus on individual currency transfers. The Borderless Account provides users with flexibility and convenience in dealing with different currencies.

Business Solutions:

Wise/TransferWise offers specialized business solutions, such as bulk payments, global payroll, and multi-currency accounts for businesses. This focus on catering to the specific needs of businesses gives Wise/TransferWise an edge over money transfer services that primarily target individual customers.

User-Friendly Interface:

Wise/TransferWise provides a user-friendly platform and mobile app that make it easy to navigate and initiate transfers. The intuitive design, real-time updates, and clear transaction history enhance the user experience. This sets Wise/TransferWise apart from some other services that may have complicated or outdated interfaces.

Regulatory Compliance and Security:

Wise/TransferWise operates as a licensed and regulated financial institution, adhering to strict security and privacy regulations. This compliance offers peace of mind to users, ensuring the safety and security of their funds and personal information. Some other money transfer services may not have the same level of regulatory oversight.

While other money transfer services have their strengths, Wise/TransferWise distinguishes itself with its transparent fees, competitive exchange rates, fast transfers, multi-currency accounts, business solutions, user-friendly interface, and regulatory compliance. These factors make Wise/TransferWise a preferred choice for individuals and businesses looking for reliable and cost-effective money transfer solutions.

Conclusion

Wise, formerly known as TransferWise, offers a comprehensive and innovative solution for international money transfers. With its transparency, competitive exchange rates, and user-friendly platform, Wise has gained popularity as a reliable and cost-effective alternative to traditional banks and other money transfer services.

Through its peer-to-peer model, Wise eliminates the need for costly currency conversions and offers better rates than traditional banks. The transparent fee structure ensures that customers know exactly how much they’re paying, without any hidden charges. Fast transfers and real-time updates provide convenience and peace of mind, allowing users to track their funds efficiently.

The Wise/TransferWise Borderless Account and debit card enhance flexibility and convenience, enabling users to hold and manage money in different currencies. Whether you’re an individual, a frequent traveler, or a business dealing with global transactions, the multi-currency features offer freedom and efficiency.

Wise/TransferWise also caters to the specific needs of businesses with its tailored solutions, including bulk payments, global payroll, and multi-currency accounts. These services streamline international financial operations and reduce costs for businesses of all sizes.

In comparison to traditional banks, Wise/TransferWise stands out with its competitive rates, transparent fees, speed, multi-currency support, user-friendly interface, and emphasis on security. These advantages make Wise a preferred choice for individuals and businesses seeking cost-effective and efficient international money transfer services.

While other money transfer services exist, Wise/TransferWise sets itself apart with its transparent pricing, real-time updates, and comprehensive solutions. Regulatory compliance, stringent security measures, and a trusted network of financial partners further enhance the reliability and safety of Wise’s services.

In conclusion, whether you’re sending money to support family members overseas, making international business transactions, or managing finances across borders, Wise/TransferWise offers a reliable, transparent, and cost-effective solution for your international money transfer needs.